A Firm Has a Debt-equity Ratio of .62

If there are no taxes or other. Operating efficiency equity multiplier and profitability ratio.

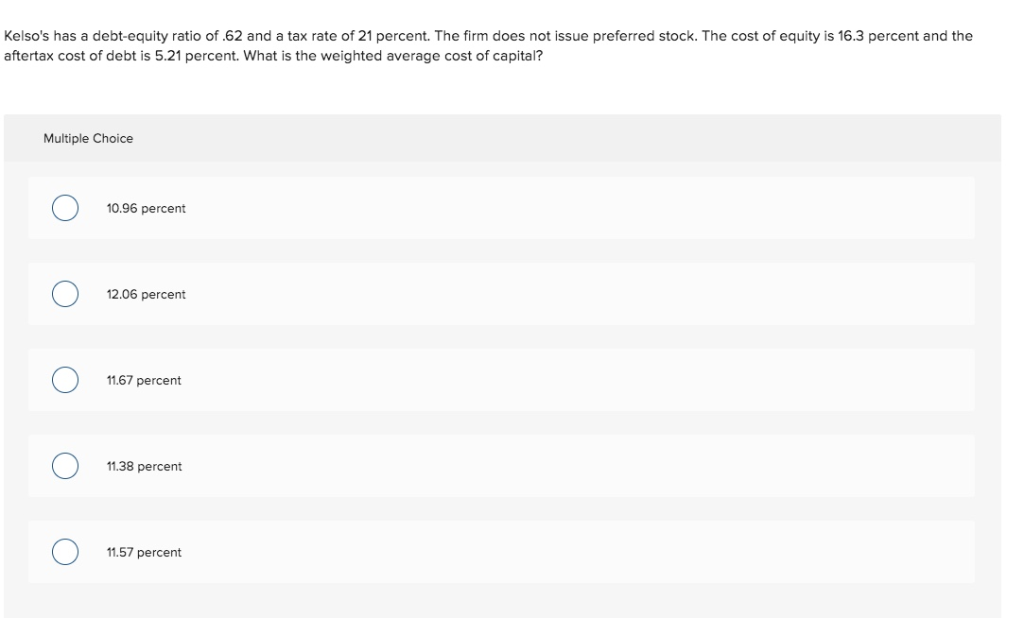

Solved Kelso S Has A Debt Equity Ratio Of 62 And A Tax Rate Chegg Com

Answer of Assume a firm has a debt-equity ratio of 62.

. A firm has a debt-equity ratio of 62 a total asset turnover of 124 and a profit margin of 51 percent. What is the amount of the net income. Pages 145 This preview shows page 143 - 145 out of 145 pages.

School Lebanese American University. What is the return on equity. A firm has a debt equity ratio of 62 percent a total.

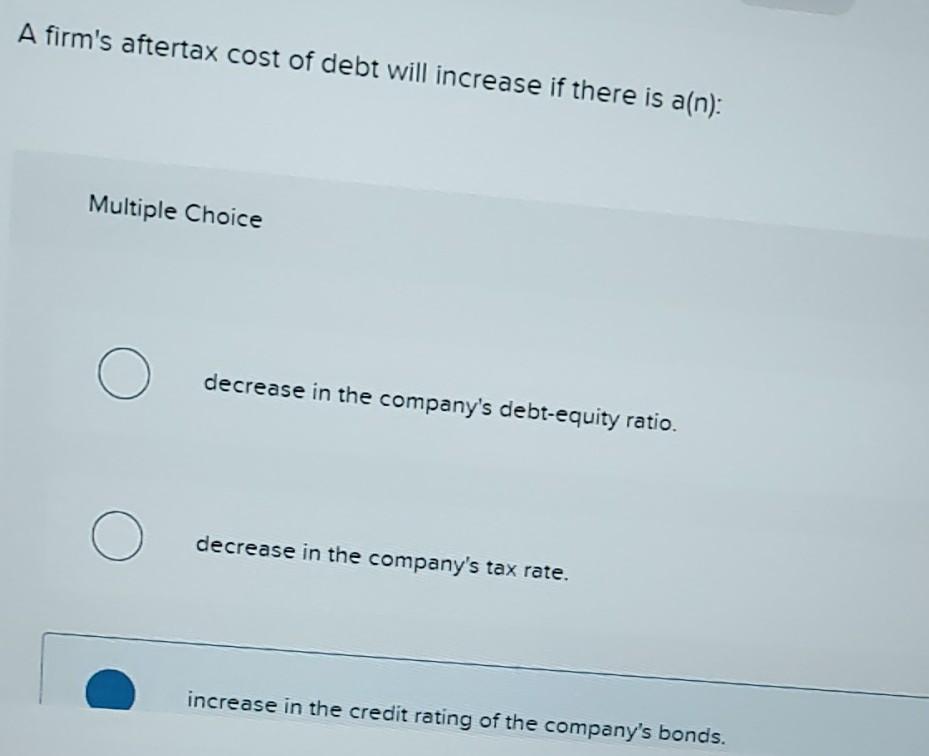

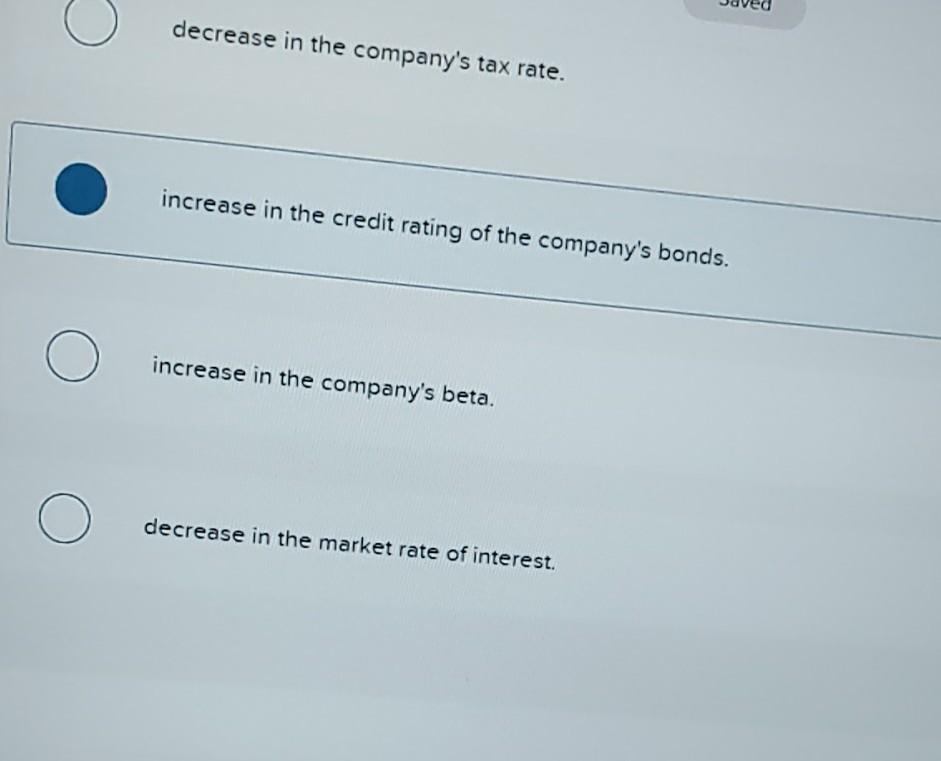

The company has a debt-equity ratio of 62. Decrease in the quick ratio. Course Title FINANCE 301.

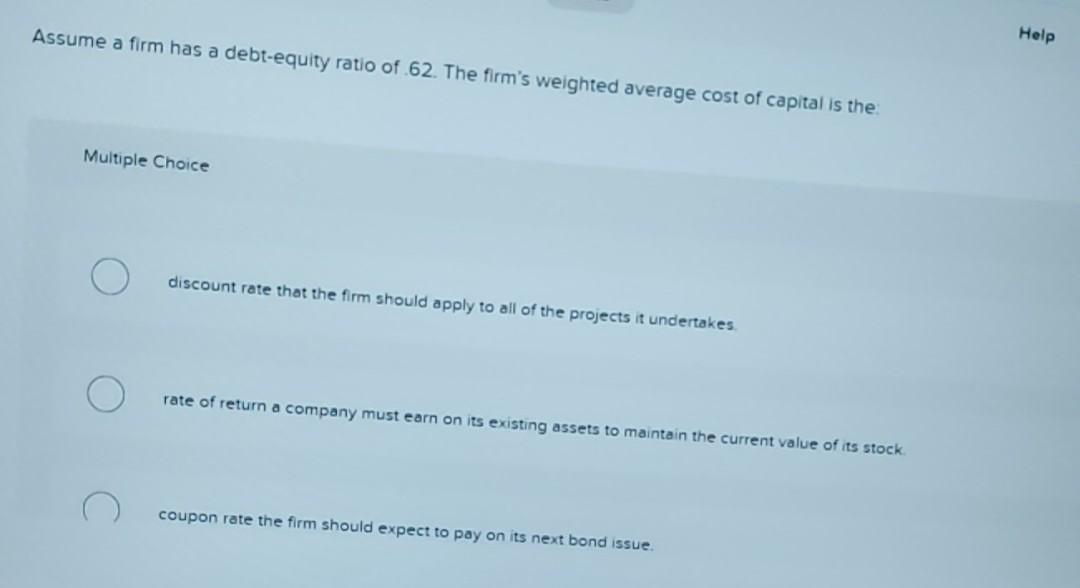

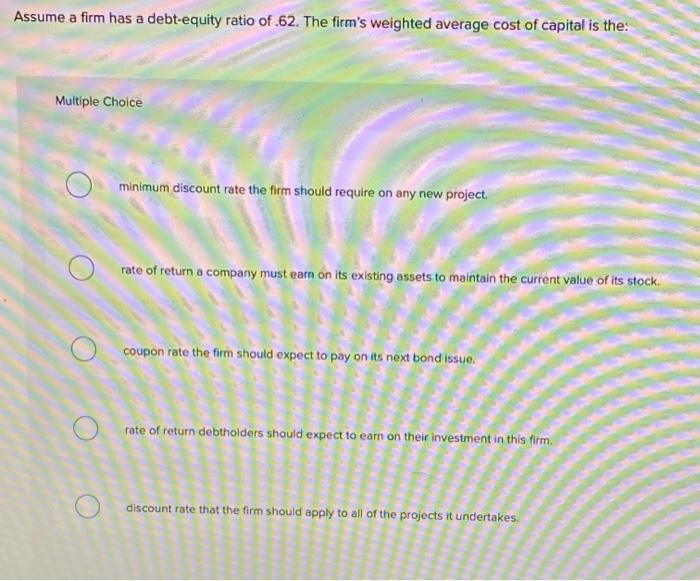

The firms weighted average cost of capital is the. 100 A firm has a debt equity ratio of 62 a total asset turnover of 124 and a. 2 7 a firm has a debt equity ratio of 62 percent a.

The firms weighted average cost of capital is the Help Multiple Choice discount rate that the firm should apply to all of the projects it undertakes rate of return a company must earn on its existing assets to maintain the current value of its stock coupon rate the firm should expect to pay on its next bond issue. Assume a firm has a debt-equity ratio of 62. A ratio of 1 would imply that creditors and investors are on equal.

Its cost of equity is 16 and its cost of debt is 8. A firm has a debt-total asset ratio of 58 percent and a return on total assets of 13 percent. Its cost of equity is 20 and its cost of debt is 15If the corporate tax rate is 34 what would its cost of equity be if the firm was all equity financed.

Course Title FINANCE 301. Debt-equity ratio capital intensity ratio and profit margin. A firm has a debt-to-equity ratio of 1.

Multiple Choice minimum discount rate the firm. What is the weighted average cost of capital. School University of the Thai Chamber of Commerce.

The total equity is 672100. School Lebanese American University. Pages 5 This preview shows page 2 -.

A 210 B 130 C 240 D 350 E 190 Answer. The dependent variables used in this study is the Company Value with indicators of. Rate of return a company must earn on its existing assets to maintain the current value of its stock.

The Corner Bakery has a debt-equity ratio of 062. Course Title FINANCE 123. The optimal DE ratio varies.

The firms cost of equity is 151 percent and its aftertax cost of debt is 73 percent. 2 Medium Topic. On december 31 year 3 smoke reclassified a security acquired during the year for 70000.

This means that for every dollar in equity the firm has 42 cents in leverage. A firm has a debt-equity ratio of 062 and a tax rate of 35 percent. 100 a firm has a debt equity ratio of 62 a total.

Its return on equity is 15 percent. Assume a firm has a debt-equity ratio of 62. The cost of equity is 163 percent and the aftertax cost of debt is 521 percent.

It had a 50000 fair value when it was reclassified from trading to available-for-sale. The firms required return on assets is 142 percent and its cost of equity is 161 percent. What is the amount of the net income.

What is the amount of the net income. 2 7 A firm has a debt equity ratio of 62 percent a total asset turnover of 139. An available-for-sale security costing 75000 written down to 30000 in year 2 because of an other-than-temporary.

Coupon rate the firm should expect to pay on its next bond issue. The total equity is 489600. A firm has a debt equity ratio of 62 percent a total asset turnover of 139 and a.

A firm has a debt-equity ratio of 62 a total asset turnover of 124 and a profit margin of 51 percent. Multiple Choice minimum discount rate the firm should require on any new project. A firm has a debt-to-equity ratio of 062.

An increase in current liabilities will have which one of the following effects. What is the amount of the net income. The firm has a debt-to-equity ratio of 15.

Kelsos has a debt-equity ratio of 62 and a tax rate of 21 percent. What is its cost of equity for a firm if the corporate tax rate is 40. Keyboard Navigation 104 Canine Supply has sales of 2800 total assets of 1900 and a debt-equity ratio of 5.

What is the net income. The total equity is 489600. A firm has a debt-equity ratio of 62 percent a total asset turnover of 124 and a profit margin.

What is the pre-tax cost of debt based on M M Proposition II with no taxes. If it had no. The firm does not issue preferred stock.

The Study investigated the influence of Debt to Equity Ratio and Firm Size on Firm Value with Return On Equity as intervening variables in Jakarta Islamic Index JII in 2016-2018. The total equity is 489600. The total debt of a business is worth 50 million and the total equity is worth 120 million then debt-to-equity is 042.

The debt-to-equity ratio is calculated by dividing a corporations total liabilities by its shareholder equity. Net income 190 Difficulty. The financial statements are key to both financial modeling and accounting.

Answer in decimal form and round answer to 4 decimal places round intermediate calculations to 5 decimal places. The firms weighted average cost of capital is the. The following pertains to smoke incs investment in debt securities.

This study uses two independent variables that Debt to Equity Ratio and Firm Size. An Edmonton firm has a debt-equity ratio of 62 percent a total asset turnover of 139 and a profit margin of 78 percent. The companys cost of equity is 118 percent and the aftertax cost of debt is 49 percent.

A firm has a debt-equity ratio of 62 percent a total asset turnover of 124 and a profit margin of 51 percent. The firm feels that the project is riskier than the company as a whole and that it should use an adjustment factor of 3 percentWhat is the WACC it should use for the project.

Solved Assume A Firm Has A Debt Equity Ratio Of 62 The Chegg Com

Solved Assume A Firm Has A Debt Equity Ratio Of 62 The Chegg Com

Solved Assume A Firm Has A Debt Equity Ratio Of 62 The Chegg Com

Solved Assume A Firm Has A Debt Equity Ratio Of 62 The Chegg Com

No comments for "A Firm Has a Debt-equity Ratio of .62"

Post a Comment